Understanding Market Trends and how to use them for better Investment Decisions

Learn how to understand and analyze market trends to enhance your investment strategies. This comprehensive guide covers the types of market trends, how to recognize them, and practical tips on using them to make informed investment decisions.

In the dynamic world of investing, staying ahead of market trends can significantly impact your investment success. Understanding and analyzing market trends not only helps you make informed decisions but also strategically positions your investments. This article provides in-depth guidance on market trends, their types, how to recognize them, and practical tips for leveraging them to enhance your investment strategy.

What Are Market Trends?

Market trends refer to the general direction in which the price of an asset, such as a stock, bond, or commodity, moves over a specific period of time. Identifying these trends is important for investors as it helps predict future price movements and make informed investment decisions.

Types of Market Trends

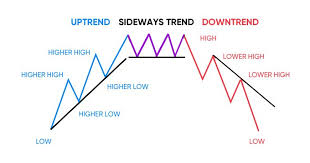

In the stock market, trends refer to the general direction in which the prices of a particular asset or market are moving over time. There are three main types of trends: uptrend, downtrend, and sideways trend.

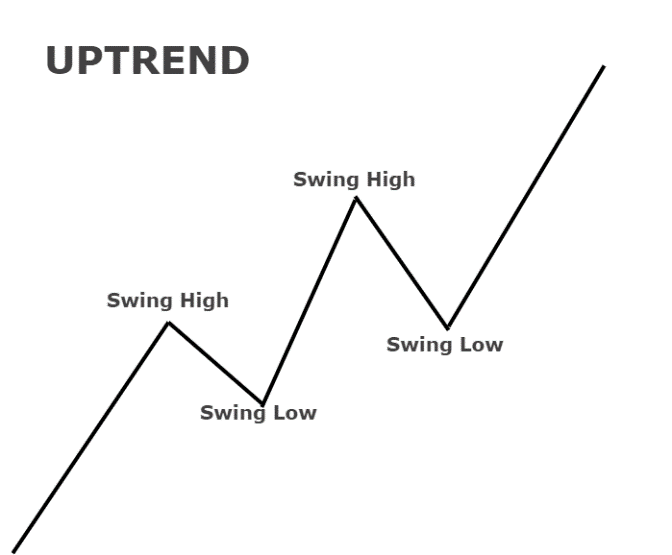

- Uptrend (Bull Market)

- Definition: An uptrend is characterized by rising prices and is often associated with a bull market. In this phase, the market shows a consistent upward movement.

- Indicators: Higher highs and higher lows, increasing investor confidence, and strong economic indicators.

- Investment Strategy: During an uptrend, consider buying and holding stocks or investing in growth-oriented assets to maximize gains.

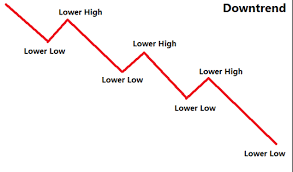

2. Downtrend (Bear Market)

- Definition: A downtrend is marked by falling prices and is associated with a bear market. This phase is characterized by a consistent downward movement.

- Indicators: Lower lows and lower highs, declining investor confidence, and negative economic indicators.

- Investment Strategy: In a downtrend, it may be prudent to adopt a defensive approach, such as investing in bonds or other safe-haven assets.

3. Sideways Trend (Range-Bound Market)

- Definition: A sideways trend occurs when the market moves within a horizontal range without a clear upward or downward direction.

- Indicators: Flat highs and lows, stable economic conditions, and no strong momentum in either direction.

- Investment Strategy: During a sideways trend, focus on short-term trading opportunities or consider diversifying your investments to manage risk.

How to Identify Market Trends

Identifying market trends involves analyzing various data points and indicators to understand the direction in which a market is moving. Here are some key methods and tools you can use to identify and understand market trends:

- Data Analysis:

- Historical Data: Review historical price data and trading volumes. Trends often become apparent when you analyze data over time.

- Statistical Tools: Use statistical measures like moving averages, standard deviations, and regression analysis to identify patterns and trends.

- Technical Analysis:

- Charts: Utilize various chart types (line, bar, candlestick) to visualize price movements. Patterns such as head and shoulders, flags, and triangles can indicate potential future trends.

- Indicators: Use technical indicators like moving averages (MA), relative strength index (RSI), and MACD (Moving Average Convergence Divergence) to help determine trend strength and direction.

- Fundamental Analysis:

- Economic Indicators: Monitor macroeconomic factors such as GDP growth, employment rates, and inflation. These can influence market trends.

- Company Performance: For individual stocks, analyze financial statements, earnings reports, and industry news.

- Market Sentiment:

- News and Media: Keep track of news headlines, financial reports, and industry updates. Market sentiment can often drive short-term trends.

- Social Media: Platforms like Twitter, Reddit, and financial blogs can provide insights into market sentiment and emerging trends.

- Market Research Reports:

- Industry Reports: Read reports from market research firms and industry analysts to gain insights into emerging trends and market forecasts.

- Surveys and Polls: Use consumer surveys and business polls to understand market demand and potential shifts.

- Economic and Market Cycles:

- Business Cycles: Understand where the market is in the economic cycle (expansion, peak, contraction, trough). Different phases can impact trends differently.

- Seasonal Trends: Some markets exhibit seasonal patterns that can be identified through historical data analysis.

- Algorithmic and Quantitative Methods:

- Machine Learning: Use machine learning algorithms and models to analyze vast amounts of data and identify trends that might not be obvious through traditional methods.

- Quantitative Models: Implement quantitative models that rely on mathematical and statistical techniques to predict future market movements.

- Expert Opinions:

- Analyst Recommendations: Consider insights and recommendations from financial analysts and market experts who provide forecasts and trend analyses.

Combining these methods will give you a comprehensive view of the market and help you identify and respond to trends effectively. Always remember to consider multiple factors and cross-check information to make well-informed decisions.

How to Use Market Trends in Your Investment Strategy

- Develop a Trend-Following Strategy

- Align your investment decisions with the prevailing market trend. For example, during an uptrend, consider investing in growth stocks, while in a downtrend, focus on preserving capital.

- Adjust Your Portfolio Based on Trends

- Rebalance your portfolio to match current market conditions. Increase allocations to sectors or assets performing well and reduce exposure to those underperforming.

- Set Entry and Exit Points

- Use trend analysis to determine optimal entry and exit points for your trades. Establish stop-loss orders to protect your investments from adverse price movements.

- Diversify to Manage Risk

- Even within a trend, diversifying your investments across different assets and sectors can help manage risk and enhance overall portfolio performance.

Conclusion

Understanding and analyzing market trends is an important skill for investors seeking to navigate the complexities of the financial markets. By recognizing a variety of trends, using different analytical tools, and implementing trend-based strategies, you can make more informed investment decisions and improve your chances of achieving your financial goals.

Read More Articles: Understanding the Basics of Stock Charts

Ready to enhance your investment strategy? Subscribe to our newsletter for the latest market insights and trend analysis tips delivered directly to your inbox!

Account Open : Open Free Demat Account